SIP | Mutual Funds

Whether you're planning for retirement, education, marriage or a dream vacation, the diverse mutual fund options cater to every investor profile. Trust us to guide you toward a prosperous financial future.

Our dedicated team of professionals analyse market trends, risk profiles and Investment goals to create portfolios that align with your aspirations.

FAQs

It's crucial to note that these are general FAQs, and specific details may vary based on the mutual fund scheme and the regulations in force. Investors are advised to read the scheme documents and consult financial experts for personalized advice.

- What are mutual funds ?chevron_right

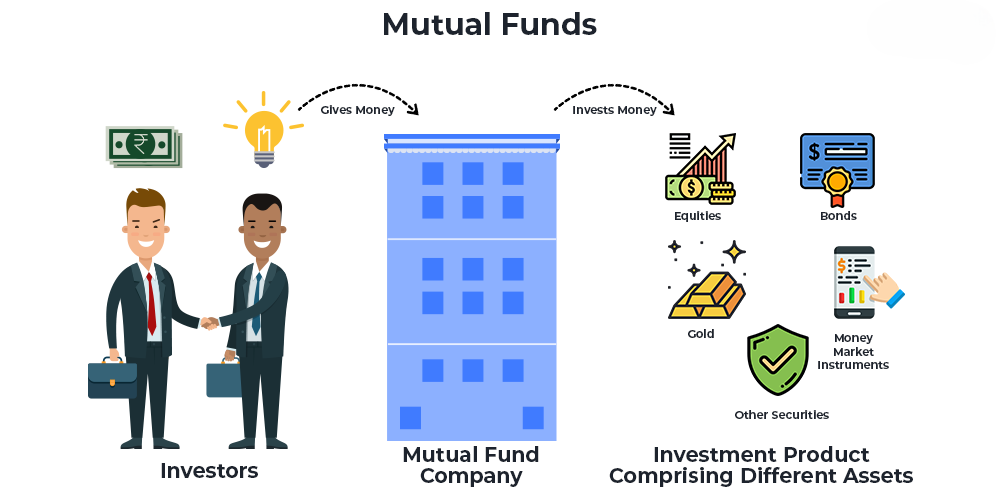

- A mutual fund is a financial instrument pools money from various investers to invest in a diversified portfolio of stocks, bonds, or other securities, managed by a professional fund manager.

- What are the types of mutual funds in India ?chevron_right

- Mutual funds in India can be categorized into equity funds, debt funds, hybrid funds, and solution oriented funds. Equity funds invest predominantly in stocks, debt funds in fixed-income securities, hybrid funds in a mix of both, and solution-oriented funds for specific financial goals like retirement or education.

- What is SIP ?chevron_right

- SIP is a method of investing in mutual funds where an investor contributes a fixed amount monthly. This helps in rupee cost averaging and disciplined investing.

- Are mutual funds risk-free ?chevron_right

- Mutual funds are subject to market risks, and the value of investments can go up or down based on market conditions. However, a diversified portfolio can help in managing risks.

- What are the tax implications on equity mutual funds ?chevron_right

- The tax treatment depends on the holding period. Long-term capital gains may be taxed differently from short-term

gains.

- Short Term Capital Gains Tax (STCG) - 20% tax on capital gains if your holding period is less than 1 years

- Long Term Capital Gains Tax (LTCG) -12.5% with 1.25 lakh tax free on capital gains if your holding period is more than 1 year Long term

capital gain upto Rs. 1 lakh is "tax free"

Example -If you invested Rs. 5 lacs in equity mutual funds and it becomes Rs. 7 lacs, and if you decide to redeem your mutual funds, then Rs. 2 lacs is the capital gain.

If your investment period is over 1 year: Rs. 1.25 lacs is tax free and Rs. 75,000 will be taxable at 12.5% i.e., Rs. 9,375.

If your investment period is less than 1 year: The whole capital gain of Rs. 2 lacs will be taxable at 20% i.e., Rs. 40,000. - What are tax saving schemes ?chevron_right

- These schemes offer tax deduction to the investors under Section 80C of the Income Tax Act, 1961. They are called Equity Linked Savings Schemes (ELSS).

- Is there any lock-in period in mutual funds?chevron_right

-

There is no lock-in in mutual funds except for some specified funds like tax-saving mutual funds /ELSS, retirement fund, children fund etc. , hence mutual funds can be redeemed at any time.

- Is there any exit charge or exit load in case of redemption of mutual funds?chevron_right

- In mutual funds, an exit load is a fee charged by the Asset Management Company (AMC) when an investor redeems or sells their mutual fund units before a specified holding period. Exit loads are typically calculated as a percentage of the redemption amount. Different mutual fund schemes have different exit load percentage and different holding periods. Some schemes may not charge exit load.